According to GrowthList, 44% of startups fail because they run out of cash. Raising capital for your business can be a challenging task, and it can be one of the most important decisions you make at the early stage of your business.

In this post, we’re diving deep into 18 mind-blowing statistics about raising capital for startups in 2024. What do they matter? These numbers won’t have a huge impact on your business but they can certainly help you identify some opportunities and help you have the right expectations when you are raising capital for your startup business.

Venture Capital

1. The Median of a Series A funding round in the U.S in 2024 is around $18 million (Fundz)

There was a slight decrease compared to $22 million in the first half of 2023. However, with a typical Series A funding ranging from $2 to $15, it’s still a positive sign as 50% of the startups received equal to or more than $18 million at the start of 2024.

2. Less than 1 in 2000 startups actually receive VC funding. (Fundera)

Securing venture funding is extremely difficult. If you are looking to raise capital through venture capital firms, make sure you understand that is competitive and the chances are slim.

3. Only around 25% of VC funds were allocated to women-led companies in 2023. (The Conversation)

Although the number of women entrepreneurs has risen over the last few decades, the majority of the VC funds were still allocated to companies led by men in 2023. There are reasons why this is the case, but it certainly gives us something to think about.

4. Black-founded startups received less than 0.5% of venture funding in the U.S. in 2023. (CrunchBase)

What is more disheartening to see is that only 0.5% of venture funding went to black-founded startups in 2023, which is a decrease of 71% compared to 2022.

5. Global venture funding falls 42% to $248.4B in 2023, the lowest since 2017 (CB Insights)

Although the total global venture funding fell significantly, there was a slight increase in funding for the fintech and retail tech sectors.

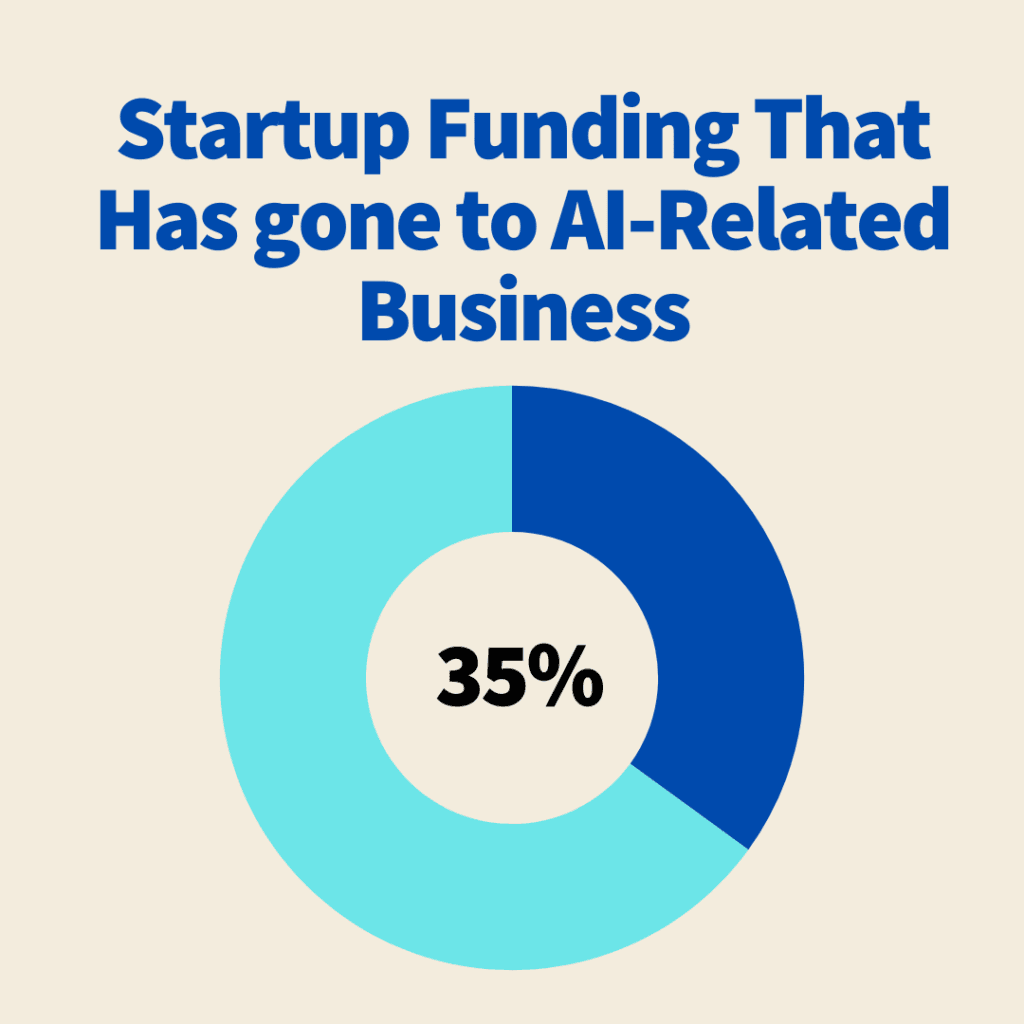

6. 35% of U.S. startup funding has gone to AI-related startups in 2024, compared to 15% in 2021 (Crunchbase)

With the boom of AI, it’s not surprising that there is an increase in funding going to AI-related startups. AI has changed our lives and it will continue to shape the future of our world.

7. $5.6 billion has gone to biotech and health companies across 110 rounds, which accounts for 53% of all Series A funding. (Crunchbase)

Despite AI hype, our priorities still remain clear. Biotech and health companies continue to receive a significant portion of Series A funding.

8. The Cleantech industry has experienced a huge growth of 20.56% since last year, with an average investment value of 16.7 million US dollars per funding round. (StartUs Insights)

More and more people are aware of the importance of taking care of our environment, and the growth is proof of that.

Angel Investment

9. Typical angle investment received by startups ranges from $100000 to $250000 (A2D Ventures)

That’s what you can expect if you are looking for angel investors. But keep in mind that many factors can influence the amount of funding you receive. Another thing to note is that on rare occasions, the funding you receive can even go up to $1 million.

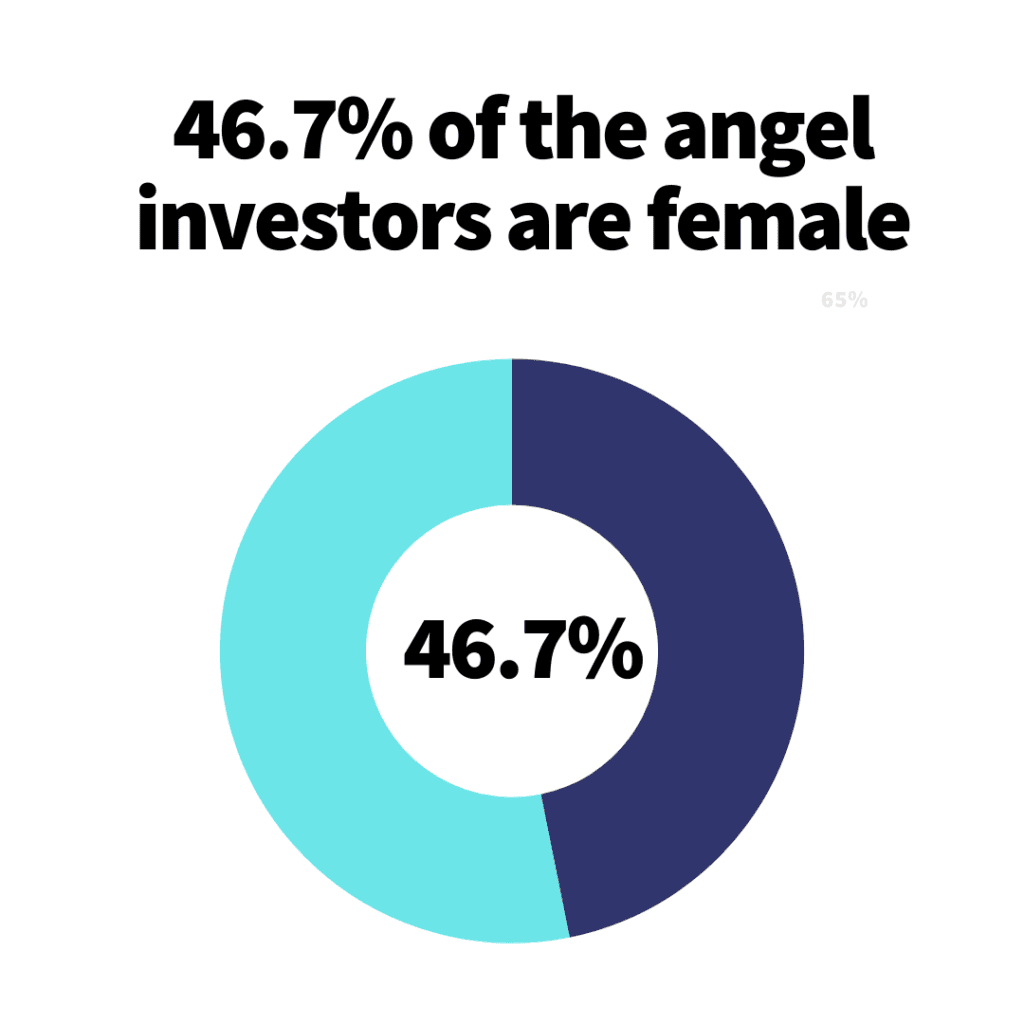

10. In 2023, 46.7% of the angel investors are female, rising from 39.5% in 2022. ( Center of Venture Research)

Although it was disappointing knowing that most VC funding goes to men-led companies, it’s good to know that women are as capable as men!

11. 78% of angel investors had more than five years of experience in private companies investing. (VentureChoice)

Interesting statistics to know and this can mean many things. What I think it means is being an angel investor and investing in startups is risky and challenging, and it takes time to be good at this game, So if you plan to be an angel investor in the future, have the right expectations and don’t quit so early.

Alternative Funding Sources

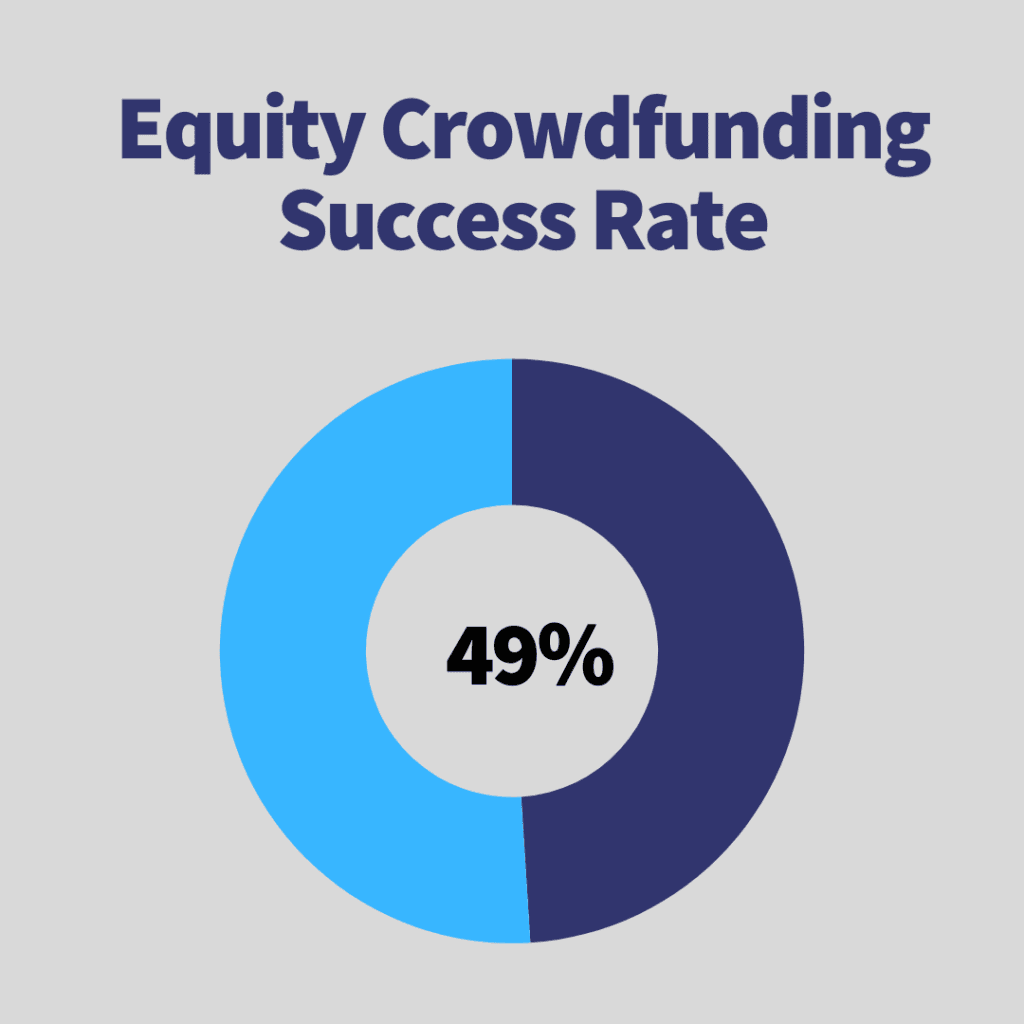

12. The success rate of equity crowdfunding in the U.S is 49%, with a total amount of $252.2 M raised in 2023. (FAU College of Business)

If you haven’t given a thought about equity crowdfunding, you should. It has a higher success rate than VC funding and you can still raise the money you need for your business.

13. The total crowdfunding raised between 2023-2024 in Australia amounts to AUD $64.5 million. (CFO Tech Australia)

There is an increase in companies using equity crowdfunding to raise capital in Australia, with a success rate of 46%.

14. The average successful reward-based crowdfunding per campaign amounts to US$8.15k in 2024 worldwide. (Statista)

Reward-based crowdfunding provides a non-cash reward for investors such as products or services in exchange for capital, it’s a good way to raise some money to get your business started.

15. 41.15% of Kickstarter projects reached their funding goals. (Statista)

If you need to test your MVP and need money to improve your MVP, start with Kickstarter. 41.15% of people have no problem getting the money they need.

16. Kickstarter has received pledges worth 7.8 billion US dollars as of January 2024. (Statista)

The funding pledged to Kickstarter projects has continued to grow steadily, reaching 7.8 billion US dollars. Hundreds of campaigns have raised over $1 million US dollars.

17. Games was the most funded project category on Kickstarter as of January 2024, with 2.36 billion US dollars pledged. (Statista)

Who doesn’t play games? Video games, board games, you name it. Frosthaven was the highest-funded gaming project on Kickstarter as of January 2024, raising around 13 million U.S. dollars.

18. Revenue-based financing deals are expected to grow to $5.78 billion from $3.38 billion this year at a compound annual growth rate (CAGR) of 70.9%. (The Business Research Company)

Rewarding your investors a share of the future revenue of your business is a convenient way to raise capital. You can retain full ownership and control of your company while still scaling your business.

Conclusion

There you have it, 18 statistics about raising capital for startups. I hope these statistics have been useful to you and wish you all the best.

Want to start your own online business?

Want to start your own online business but don’t know where to begin? Check out our free guide on “How to Start An Online Business”. This guide gives you a step-by-step roadmap, guiding you from brainstorming ideas to choosing the right business model, all the way to launching your business.

Subscribe to my newsletter and grab yours today.

Pingback: The Freemium Business Model: When and How to Use It