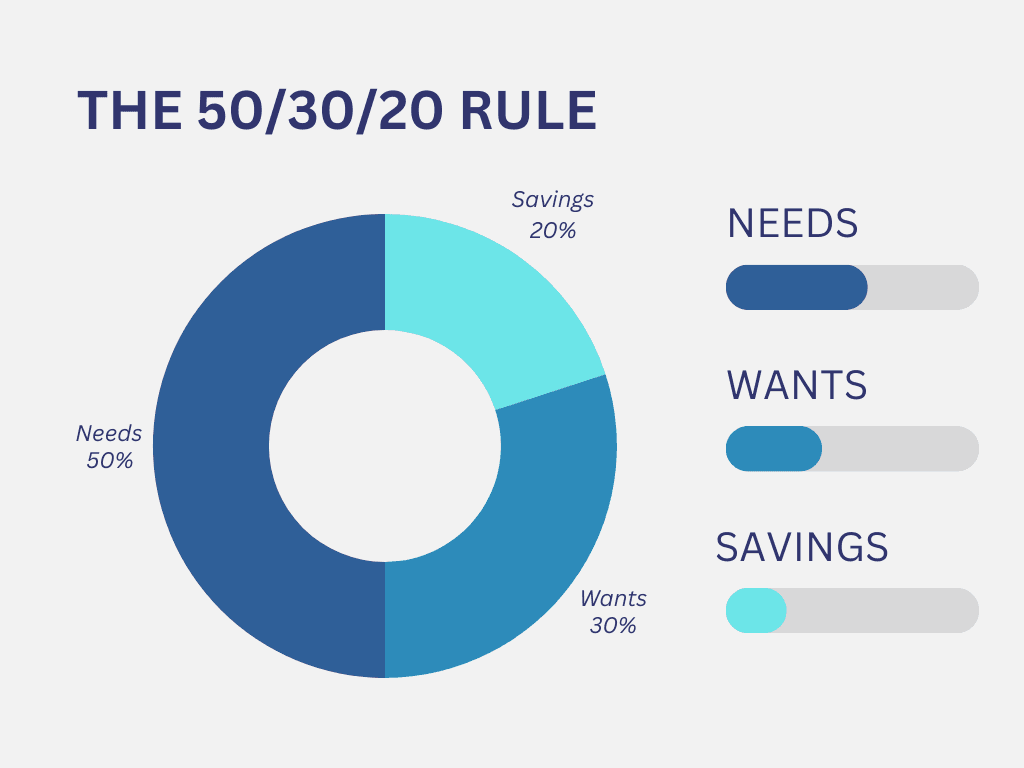

What is the 50/30/20 rule

The 50/30/20 rule is a budgeting rule created by U.S senator Elizabeth Warren. It states that you should spend 50% of your after-tax income on needs, 30% on wants, and 20% on savings and debt repayment.

The 50/30/20 Rule(Modified)

50% Needs

Needs are necessities that are essential for your survival. Half of your after-tax income is usually used to cover those expenses. If you needs are more than 50% of your income, try to lower your expenses such as taking public transportation, or reduce the frequencies of eating out.

- Utility

- Rent

- Mortgage

- Groceries

- Transportation

- Health care

- Debt repayment

They should be the basic needs in your life. If you need furniture such as a sofa, that will be a need. But an upgrade to a luxurious and expensive sofa will be a want.

30% Wants

30% of your after-tax income can be spent on anything you want. These are the things that are optional but not needed (you won’t die or suffer from a serious consequence if you don’t get them). As mentioned above, wants include things that you upgrade options. Such as getting a more luxurious sofa, or branded clothing.

- A5 wagyu steak!

- Branded clothes

- Louis Vuitton bags

- Tesla

- Video games

- Air pods

- Netflix Subscription

20% Savings and Investments

Lastly, 20% of it should be saved or used for investment. You can save the money for an emergency fund and use part of it for real estate investments, stocks or start your own business.

Should you use the 50/30/20 rule?

Yes and no. The 50/30/20 rule should be used as a guide and modified according to your situation and age. Some people might need to allocate 70% of their after-tax income on needs. While if you are in your 20s, still living with your parents, or with no financial responsibilities, you can allocate more of your income towards savings and investments. However, if you spend 70% of your income on needs, you have to find ways to reduce your expenses of increase your income.

Conclusion

The 50/30/20 is a rule that everyone should use as a guide to create their own budgeting rule. The aim is to reduce your expenses as much as you can and use that for investment or even starting a business so you can achieve financial freedom early in life.

Subscribe to our newsletter so you don’t miss out on any content.

Calculate how your investment can grow over time by using a compound interest calculator.

If you are struggling to reduce your expenses, check out this post to save more money in 2024. “How to Save Money: 14 Tips That Work”

Don’t have an emergency fund yet? Read this post and start building today. “A Guide to Emergency Fund”

“Unleash your potential and achieve financial freedom”